Eliminate potential problems or issues before they arise

A buy-sell agreement may:

• Provide liquidity for your family

• Create a guaranteed market for your business interest

• Allow those who are interested in continuing your business to do so without interference

• Set the purchase price and terms of payment in advance

• Establish the value of your business for federal tax purposes

• Specify how the transfer will be funded

• Improve access to credit

• Provide greater retirement security

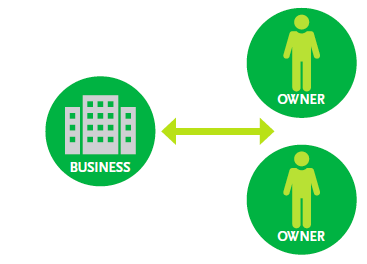

Can you afford to be without a buy-sell agreement in place? You have options There are different types of buy-sell agreements, which type is right for you will depend on how your company is set up, how many owners there are, what your cash flow may be. Common types of buy-sell agreements: In an Entity buy out the business purchases the business interest from the selling owner.

A buy-sell agreement may:

• Provide liquidity for your family

• Create a guaranteed market for your business interest

• Allow those who are interested in continuing your business to do so without interference

• Set the purchase price and terms of payment in advance

• Establish the value of your business for federal tax purposes

• Specify how the transfer will be funded

• Improve access to credit

• Provide greater retirement security

Can you afford to be without a buy-sell agreement in place? You have options There are different types of buy-sell agreements, which type is right for you will depend on how your company is set up, how many owners there are, what your cash flow may be. Common types of buy-sell agreements: In an Entity buy out the business purchases the business interest from the selling owner.

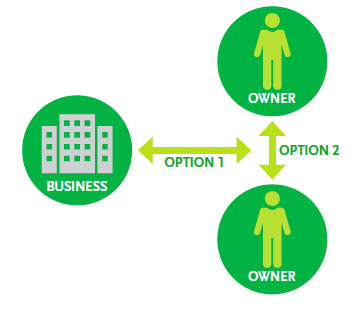

Using a Cross Purchase buy out, the co-owners purchase the business interest from the selling owner.

Each type of plan has its own unique features and benefits. Does it sound complicated? Don’t worry – it’s really not. Our role is to understand your goals and objectives and work with you and your other advisors to design a plan that is right for you, including the appropriate funding options. Don’t procrastinate Don’t leave the future of your business to chance, plan today for your business to survive if you were to experience a triggering event such as death, disability or retirement. Buy sell planning should be a vital part of your business operating plan and your family’s financial security.