This concept is not much different than financing a house – you use a mortgage to leverage the assets you have on hand to buy more house than you could afford on your own. Money is borrowed to buy more house, or with Kai-Zen, more benefits. With Kai-Zen, you are buying a life insurance policy with a larger death benefit, more living benefit protections, and the potential for more cash accumulation without the risk of losses (due to declines in a market index).

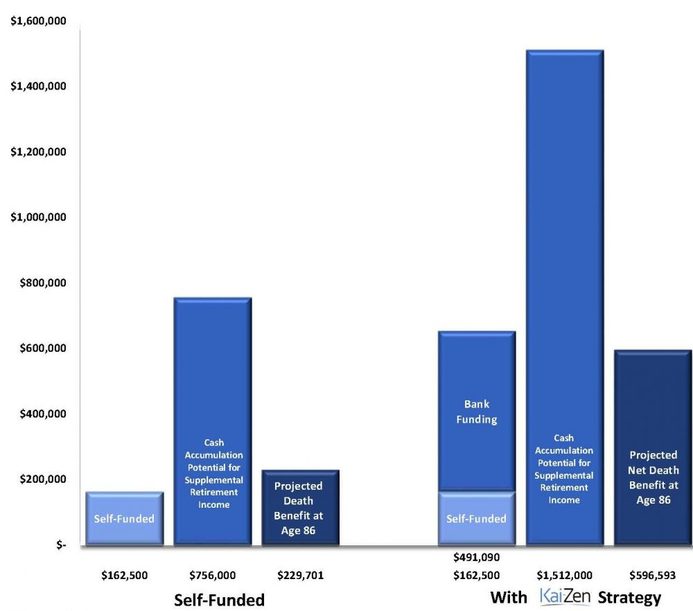

As you can see from the chart below, the addition of bank funding gives you the potential to significantly enhance the funds available for benefits.

As you can see from the chart below, the addition of bank funding gives you the potential to significantly enhance the funds available for benefits.