INDIVIDUALS & FAMILIES

Regardless of where you are in life, there's probably a lot going on. Taking care of your financial needs may not be top of mind. That's where a Smart Living Financial professional can help. Whether you are planning for you, your family, or for your business, we have a variety of Financial Solutions to help you meet your financial goals.

We use Indexed Universal Life Insurance as a Powerful Financial Engine through Smart Cash Accumulation Plans and Smart Protections with Living Benefits.

TIME TO START

STARTING YOUR CAREER

What an exciting time, you have a bright future ahead of you. Time, believe it or not, is your biggest asset. There will be many financial decisions to make, money to invest and benefits to select. Paying and protecting yourself first will pay off in the long run. There are a variety of financial solutions you can take advantage of to help protect what you have begun to build. Pay yourself first.

GETTING MARRIED

Planning your big day is one thing, planning your life together is another exciting challenge. Deciding where to live, putting a budget together for the first time and thinking about protecting the one you love: any or all of these can be challenging. But they don’t have to be. It may even make sense to review prior to your walk down the aisle. We can do that. With a wide range of products and other services let us help you to protect what needs protecting, grow what needs growing and plan for what needs planning. Grow old together!

STARTING A FAMILY

One of the great privileges in life is being a parent. From the first diaper to the last day of school and beyond wouldn’t it be great to know that you took advantage of the many financial solutions available that will help protect today so you can enjoy tomorrow? Let us help you design a plan that makes sense for you. Protect and enjoy!

BUYING HOME

Congratulations! Here are the keys...and the mortgage. It will take time to truly make your home your own and to ensure that it continues to be a place of safety and security for your family. We have solutions that can ensure your family home will still be your family home in the event you become ill or die too soon. It's your castle, protect it.

TIME TO EARN

PLANNING FOR RETIREMENT

When I retire, I am going to ________. What a great question and not an easy one to answer. Retirement may be nothing more than a far off dream at this point in your life. How much money will you need? When can you retire? Can you retire? Well, that depends...on you. By beginning early enough, and proper planning with a Smart Living Financial representative, we will get all of your retirement questions answered. Let's fill in your blank.

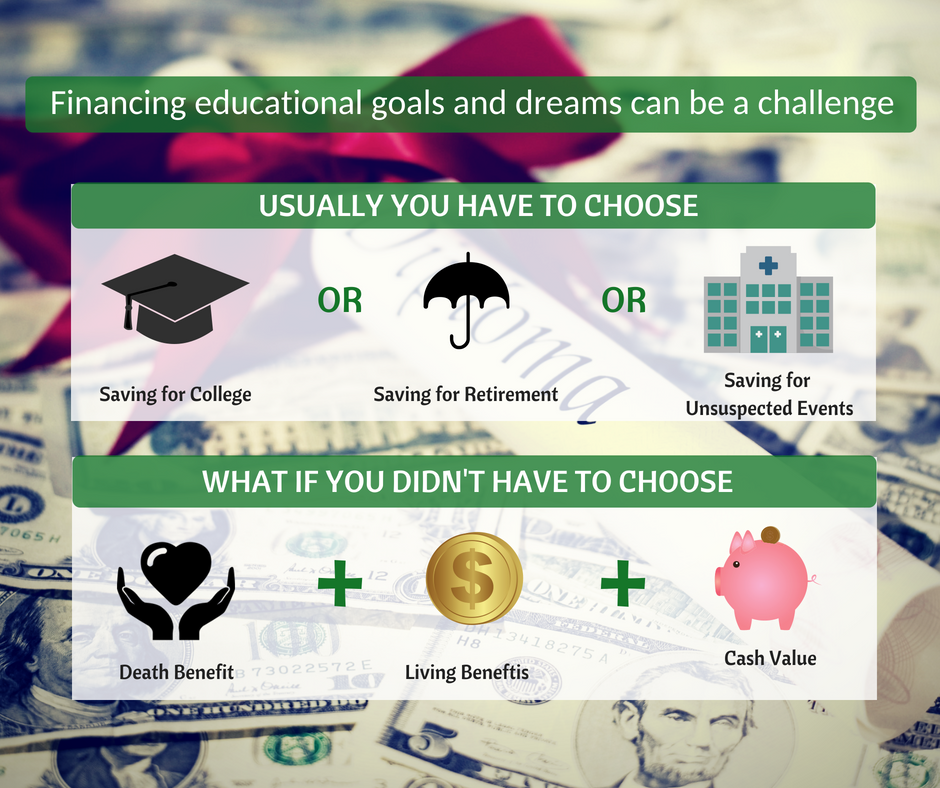

PLANNING FOR COLLEGE

"You have to start saving for college now." How many times have you heard that? Providing the opportunity for your kids to gain the advantages of higher learning is every parent's wish, but it requires a disciplined approach. With tuitions on the rise, it's never too early to start saving.

Where should you begin? Relax, we can help. We will work with you and for you to figure out the best ways...for you. Our solutions based approach will help ensure that your college savings goals will be achieved, even if you're not able to complete them. Let's get started!

Where should you begin? Relax, we can help. We will work with you and for you to figure out the best ways...for you. Our solutions based approach will help ensure that your college savings goals will be achieved, even if you're not able to complete them. Let's get started!

WILL AND TRUST PLANNING

Life can be complicated, but it doesn't have to be. Ensuring your wishes are carried out are what wills and trusts do best. These legal documents are not only for the wealthy, they can be designed to carry out a wide variety of wishes that can positively impact preserving businesses and assets as well as a variety of situations such as estate planning, disability, illness, divorce and remarriage. Learn more about how Smart Living Financial and its team of professionals can guide you, regardless of circumstance. Have your voice heard!

GETTING DIVORCED

For better or worse, life's plans do not always turn out as designed. Besides the emotional challenges being faced, there are many financial considerations that need to be reviewed now that life has changed. We have solutions and processes that can help to make sure that you are financially prepared and protected. You are not alone.

CARING FOR SPECIAL NEEDS

You have been blessed with having a special needs child. With those special needs comes special planning. No one knows what your child needs more than you. Over time, you have learned everything about them, including what their future holds and what will be required for them to live their best life. We have a dedicated team of professionals that are thoroughly prepared to help. Let's plan for the expected and prepare for the unexpected.

CARING FOR PARENTS

You may have thought of yourself as many things, but a sandwich probably wasn’t one of them. Today, as many as 1 in 8 people find themselves supporting aging parents, financially and otherwise. They have become known as the Sandwich Generation. Your parents provided so much for you; they might need your help now. If you think this might be a possibility, let us help to take the guesswork out of supporting those who supported you. It’s your turn.

TIME TO ENJOY

CREATING YOUR LEGACY

Your legacy will be how you are remembered and how you will impact the future. A big part of your legacy plan will be focused on how you want to distribute your assets to family members. Making sure you have all the proper documents like a will and possibly trusts. But a legacy is more than leaving an inheritance to your survivors - it may include benefiting a favorite charity as well. Giving and asking for nothing in return is the noblest of gestures. Organizations that do so much for so many simply could not exist without charitable donations. As a retiree, your time will certainly be invaluable and you may want to give back in some form or fashion. There are concepts that will allow you to establish a legacy that will provide for your family and others today and for many tomorrows. What could be better? Our products and services can be leveraged to establish financial resources to be delivered as well as providing certain tax benefits. What is your Legacy?

ENJOYING RETIREMENT

Today many retirees face the challenge of outliving income. You have done all of the hard work up to this point and feel like you are prepared. However there are still variables that you might not be able to completely control. What you want to do is minimize those and protect yourself as much as you can against the unknown. At Smart Living Financial our team of professionals is equipped with knowledge and resources and will work with you to help ensure you are able to live life on your terms.

LEARN

LEGAL DISCLOSURE