Cash Accumulation Life Insurance can be a Powerful Financial Engine that can protect and secure you financially. A Smart Living Financial professional can help you secure the lifestyle you want in case you live a long life, have access to Living Benefits in case of illness, or leave a Legacy in case of early death.

What Makes Us Different?

Our Special Plan Designs, and our Premium Financing, Kai-Zen, Tri-Zen, are what set us apart.

Leverage Your Benefits

How it Works

Types of Life Insurance

Indexed Life INSURANCE

Ideal for those who need Smart Protections with Living Benefits but are focused on Cash Value Accumulation for lifetime needs, such as buying a home, buying a business, or for supplementing retirement income.

Indexed Life is the most flexible type of insurance. Also known as Cash Value Insurance thanks to its Cash Accumulation Benefits:

Indexed Life insurance also has Living Benefits that provide cash in the event of:

Indexed Life is the most flexible type of insurance. Also known as Cash Value Insurance thanks to its Cash Accumulation Benefits:

- Cash value grows based on Market Index.

- No risk of losses due to market declines

- Cash growth is tax deferred

- Ability to access cash value tax free

- Flexible premium

- Ability to leverage your contributions 3 to 1 to enhance your benefits: Kai-Zen.

Indexed Life insurance also has Living Benefits that provide cash in the event of:

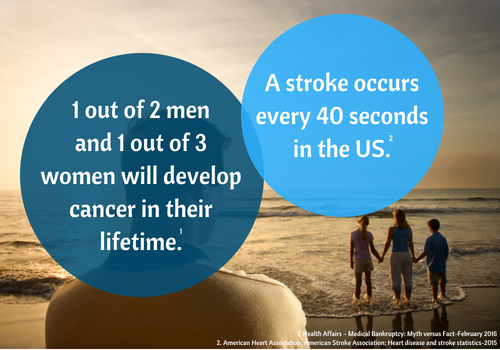

- Critical illness (Cancer, Heart Attack, Stroke, etc.)

- Critical injury (Coma, Brain Injury, Paralysis, Burns)

- Chronic illness (assistance with daily living, bathing, eating, dressing, transferring, etc.

- Terminal illness (illness where death is expected within 12-24 months

ANNUITIES

How do fixed index annuities work?

Fixed index annuities provide the guarantees of fixed annuities, combined with the opportunity to earn interest based on changes in an external market index. But because you're not actually participating in the market, the money in your annuity (your "principal") is not at risk.

Fixed index annuities can offer:

Fixed index annuities provide the guarantees of fixed annuities, combined with the opportunity to earn interest based on changes in an external market index. But because you're not actually participating in the market, the money in your annuity (your "principal") is not at risk.

Fixed index annuities can offer:

- Principal protection from market downturns

- Tax-deferred growth potential

- One or more index allocation options

- A choice of crediting methods

- Income options, including income for life

- Death benefit options

TERM LIFE INSURANCE

|

Ideal for those who have budget limitations, large protection needs, or temporary needs. It’s great for Income Protection, Mortgage Protection, etc.

OFFERS:

Term insurance also has Living Benefits that provide Cash in the event of:

|

UNIVERSAL LIFE INSURANCE

Ideal for the consumer who has a need for life insurance, is somewhat conservative, and wants the guarantees of a fixed, minimum interest rate with the potential for additional interest credits.

Increasing the death benefit may be subject to additional underwriting approval.

OFFERS:

Increasing the death benefit may be subject to additional underwriting approval.

OFFERS:

- Flexible death benefit

- Flexible premium

- Policy cash values are credited a current interest rate that is set by the insurance company, which is subject to change, but will never be lower than a guaranteed minimum interest rate.

WHOLE LIFE INSURANCE

These policies are designed for individuals who want guarantees and who are focused on providing death benefit protection over cash value accumulation.

OFFERS:

OFFERS:

- Guaranteed death benefit

- Guaranteed cash value

- Potential additional cash value by the receipt of any dividends declared by the company. Although not guaranteed, dividend payments are generally declared annually by the company.

- Level premiums that are guaranteed to never change.

Important Highlights

HIGHLIGHT #1

Indexed Universal Life Insurance, also known as Cash Accumulation Life Insurance, is the most flexible type of insurance.

HIGHLIGHT #2

Cash Accumulation Life Insurance can be a Powerful Financial Engine through Smart Cash Accumulation Plans and Smart Protections with Living Benefits.

HIGHLIGHT #3

We combine Cash Accumulation Life Insurance with Premium Financing to enhance our client's benefits.

SECURE THE LIFESTYLE YOU WANT